Since the inception of the 20th century, India has been one of the names leading the software market. The drastic technological advancement in the past few decades has led to the growth of small and medium businesses. They are mushrooming all over the country, especially during the past 2 decades. Small and Medium businesses are contributing a significant amount to the Gross Domestic Product (GDP) of our country. India is the third largest centre in terms of the number of start-ups right after USA and China. In fact, even during the COVID-19 pandemic, the number of profit-making start-ups has gone up. India has over 61 thousand MSMEs officially registered under the ‘Department of Promotion of Industries and Internal Trade’ (DPIIT) According to the Economic Survey 2021-22.

To support new initiatives as well as the existing small and medium industries, the government has taken quite a few steps. One of the steps is the use of online portals to facilitate business, transactions, grievance redressal etc. There are various portals for various purposes. In this article, you will find the functioning and purpose of these portals which would be very helpful whether you are a business owner, an employee or an eager citizen.

1. CHAMPIONS PORTAL

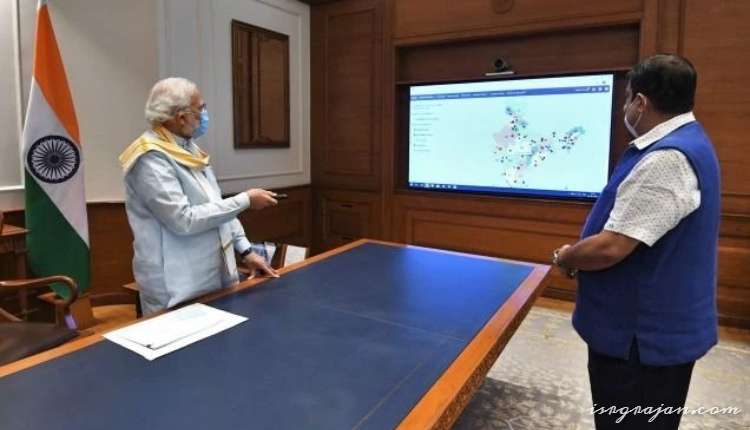

On the eve of the COVID-19 Pandemic, in 2020, the MSME ministry launched the Creation and Harmonious Application of Modern Processes for Increasing the Output and National Strength (CHAMPIONS) Portal to provide special care for the MSMEs. This is a very modern platform built using Information and Communication Technology (ICT), Artificial Intelligence, Machine Learning etc. This portal is an example of the Hub and Spoke model, while the hub is situated in Delhi, the spokes are in the states. Another noticeable feature of this portal is, that the main government portal for grievance redressal, Centralised Public Grievance Is Redress and Monitoring System (CPGRAMS) is integrated with it. It makes the web portal users friendly. The purpose of this portal is to help the MSMEs during a crisis with financial support, raw materials, labour supply, and providing licenses and permissions. This portal can further distinguish MSMEs with the potential to absorb shock and turn into big players in the national and international market in the future.

2. GeM Portal and MSME- SAMBANDH

Presently, the government has a Public Procurement Policy which (from 2015) mandates that various Government Departments, Ministries, and Public Sector Units (PSUs) must make 25% of their annual procurement from the small and medium industries. Within this target, there is a sub-target, to buy at least 4% of material from the MSEs owned by SC or ST entrepreneurs. This exercise is done through the marketplace for the government. Here the small and medium businesses can register themselves and directly sell to various government functionaries.

However, that is not it. There is another government portal to monitor the progress and implementation of the above-mentioned public procurement policy by the Central Public Sector Enterprises (CPSEs). On this portal, registered entities can look into the progress of the procurement and the status of orders directly:- https://gem.gov.in and https://sambandh.msme.gov.in/PPP_Index.aspx.

3. MSME-SAMADHAN

MSME-SAMADHAN portal has another name, “MSME Delayed Payment Portal”. One of the biggest problems faced by these small-scale industries while dealing with the government was uncertainty about payment due to delay in a release on the part of the authorities. SAMADHAN portal comes under the Ministry of Labour and Employment and the main aim is to implement the MSMED Act 2006. Now the MSMEs have the clout to directly file their complaints related to delayed payment from Central Ministries, CPSEs, PSUs and even State Governments.

4. PMEGP E-PORTAL

The Prime Minister Employment Generation Program E-portal give special emphasis on the indigenous and village industries under the aegis of the Khadi Village Industries Commission. This portal will help not only generate some revenue for the rural industries but also create a market for handicrafts, artefacts and local food processing industry products. It will generate employment in the rural sector, will reduce the burden on the agricultural sector and promote the rich Indian heritage and culture. There are two notable schemes in this regard that came out recently:

- Revamped Scheme of Fund for Regeneration of Traditional Industries (SFURTI): it aims to organize the traditional industries and artisan classes into functioning clusters to make them competitive by enhancing their marketability and providing them with required skill training.

- A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE): It aims to create new jobs and reduce the number of unemployed youths, it also nurtures entrepreneurship culture, and facilitates innovative and creative business solutions to encourage emerging companies.

5. MSME- SAMPARK

MSME-SAMPARK is a one-of-a-kind initiative by the government to connect go employers with job seekers. MSMEs, according to their requirements, can employ passed out trainees, students of eighteen MSME technology centres of our country, skilled labours etc who are registered on this portal. This digital portal will not only help create private sector jobs for the growing young population of our country but it will also open up new and creative avenues for skilled labours.

Apart from these portals, there are various other initiatives to help the MSMEs grow in India. The present Government has also established a portal called “Udyami Mitra Portal” to provide access to credit by SIDBI. Government has further come up with a scheme called Pradhan Mantri MUDRA Yojana (PMMY) to provide easy loans to small businesses. It created a government financial institution named Micro Units Development & Refinance Agency Ltd. Under this scheme, non-corporate small businesses can get last-mile financial solutions from Scheduled Banks, NBFCs, Micro-Finance Institutions (MFIs) etc. This scheme particularly focuses on backward sections of society like women entrepreneurs, SC, ST, OBC borrowers and minority community borrowers.

A pool of funds has been created by RBI to provide liquidity to MSMEs after the shock of demonetisation and GST before the pandemic and similar facilities have been extended to this sector during the outbreak of the coronavirus. However, lack of access to credit and general awareness still remains a problem in India. Proper development of micro-finance institutes, digital banks and the growth of infrastructure along with the development of MSMEs would create a healthy and competitive environment for business endeavours. As predicted by various International Agencies, India is about to reach its demographic dividend, (then our population curve will go down) India must make proper use of its young population by equipping them with improved skills and training to meet global standards